India's Economic Transformation: A Decade of Resilience and Growth (2014-2024)

Over the past decade, India’s economic trajectory has established itself as a remarkable phenomenon in global economic studies, attracting significant scholarly attention worldwide. Academic researchers Dr. Onkarnath and Dr. Deepak Kumar from Asian Business School have conducted in-depth investigations into this transformation, documenting their analysis in the International Journal for Multidisciplinary Research (2025). Their scholarly work emphasizes a critical insight: “The Indian Economy is a curious study matter for experts all around the world. This is due to the resilience it has demonstrated despite the global slowdown following the Coronavirus epidemic.”

The Foundation of Transformation: From Crisis to Opportunity

The pre-2014 economic landscape of India, as analyzed by Dr. Onkarnath and Dr. Deepak Kumar, reveals a host of structural challenges. Their frank observation—’ the situation of economy was not Great’—is supported by specific issues: delayed decision-making causing cost overruns and project hold-ups, inefficient subsidies that strained public resources without tangible impact, and stagnation in capital goods manufacturing resulting in limited value addition.”

These surface-level problems reflected more profound institutional weaknesses within the economic framework. The academic investigation reveals additional systemic constraints, notably the overwhelming presence of an “Informal sector where labor was mostly absorbed, and lack of labor in the formal sector” alongside “Low agricultural productivity magnified by lack of storage and transportation being expensive.” Furthermore, the aftermath of the 2008 Global Financial Crisis continued to impact economic performance, as the crisis “saw the NPA and bad debt hitting double digits. This led to a collapse in growth, which remained under 5% throughout the decade.”

The compelling aspect of India’s economic narrative lies in how these fundamental challenges ultimately provided the impetus for launching one of the most ambitious economic reform initiatives in modern global history.

Macroeconomic Resilience: The Numbers Tell the Story

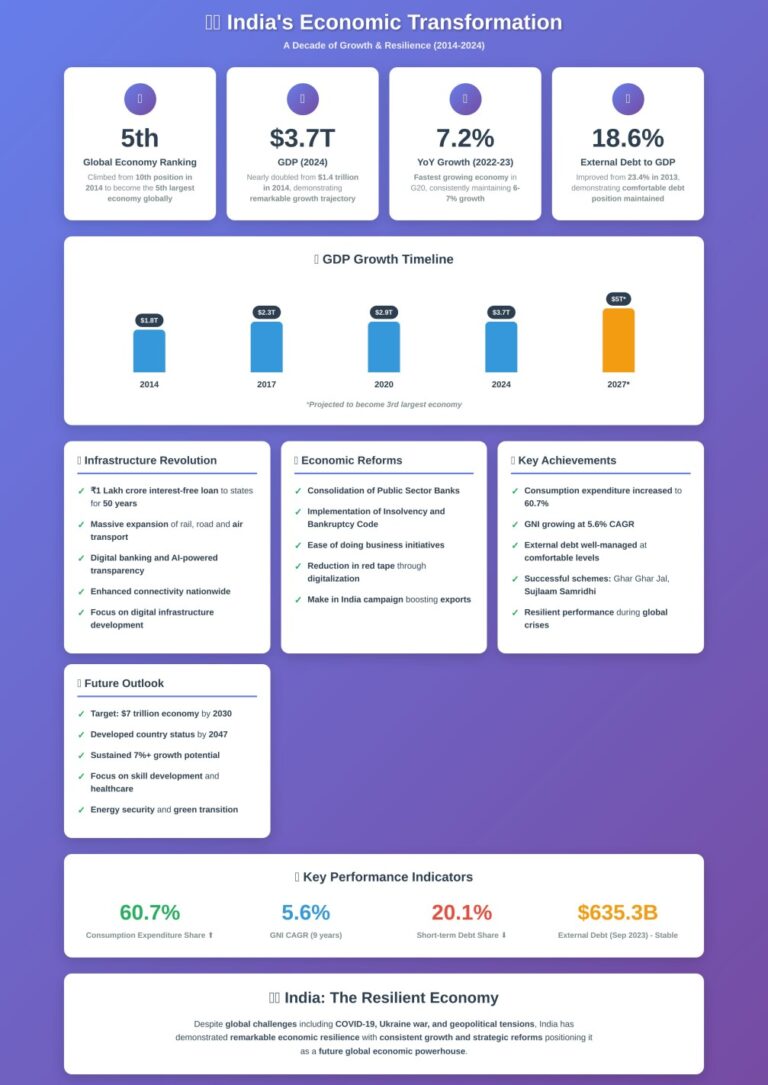

The magnitude of India’s economic evolution is demonstrated through rigorous statistical analysis performed by Dr. Onkarnath and Dr. Deepak Kumar. Their empirical research documents an extraordinary transformation: “India has climbed from the 10th largest economy, with a GDP of USD 1.9 trillion ten years ago, to 5th place today, with a projected GDP of USD 3.7 trillion for FY24.”

This achievement becomes particularly striking when examined against prevailing global economic trends during the same period. While International Monetary Fund statistics showed that international growth rates averaged merely 3.4 percent between 2012 and 2019, the academic findings reveal that “the Indian economy demonstrated remarkable resilience. Between 2014 and 2019, the economy posted a compounded annual growth rate of 7.4% at constant prices.”

Contemporary economic indicators continue to validate this upward trajectory, with data showing that “The year 2022-2023 saw a Year on year-on-year growth of 7.2% which was built on rapid infrastructure growth, which includes expansion of rail, road, and air transport.” This consistent economic performance has established India’s position as the fastest-expanding major economy among G20 nations, with the research noting that “the economy has grown by 6.4% in the past year (2024) and continues to hold steady at around 6-7%.”

Structural Reforms: Building Institutional Strength

The academic work by Dr. Onkarnath and Dr. Deepak Kumar delineates four essential domains where strategic government intervention during 2014-2024 produced lasting institutional changes. Their research establishes that “The focus of the government in the last decade has been directed toward comprehensive reform measures targeting core economic weaknesses.

Financial Sector Transformation

Reform initiatives within the banking and financial sector yielded substantial results through systematic intervention. The research documents how “the government took decisive steps to streamline the financial sector by implementing policy reforms and taking action against erring players. Initiatives like bank mergers, share market restructuring, and stricter insurance regulations have played a role in achieving favorable outcomes.”

Among these financial reforms, the Insolvency and Bankruptcy Code (IBC) emerged as exceptionally influential. Dr. Onkarnath and Dr. Deepak Kumar describe this legislation as “a major policy change that helped keep the credit taken by Industry and Companies in check. This also helped in keeping the NPA down and also changed the discipline of the Business running.” This regulatory framework went beyond addressing problematic loans, fundamentally reshaping corporate governance and accountability mechanisms across industries.

Business Environment Enhancement

Creating favorable conditions for enterprise development became a central policy objective, with systematic efforts toward “ease of business for New and Old businesses, so that the GDP growth is spurred on by the increased Economic Activity.” This transformation extended far beyond administrative streamlining to encompass a fundamental restructuring of public-private sector interactions.

Digital and Physical Infrastructure Revolution

Among the most evident aspects of India’s transformation was the modernization of infrastructure. As noted by Dr. Onkarnath and Dr. Deepak Kumar, the government adopted a broad-based approach: ‘Strengthening digital and physical infrastructure to enhance connectivity has greatly influenced economic growth. Initiatives like digital banking, promoting online settlements, and deploying Artificial Intelligence have improved transparency and simplified processes for the diaspora.”

This technological revolution has fundamentally altered access patterns to financial services and government services, creating opportunities that were previously inconceivable.

Export Promotion and Manufacturing

The academic analysis further stresses strategic developments in manufacturing and exports. It documents: ‘India’s role in global trade has grown, with the Make in India initiative driving increased exports. The surge in exports has thus contributed to shrinking the country’s trade deficit.”

Consumption and Investment Dynamics: Driving Internal Demand

The research by Dr. Onkarnath and Dr. Deepak Kumar identifies particularly encouraging developments in domestic economic activity. Their statistical analysis demonstrates that “The Consumption Expenditure increased from 58.3% in 2019 to 60.7% in the last 5 Years,” which served as a crucial stabilizing factor during periods of international economic volatility.

Capital formation patterns have similarly shown significant enhancement. The academic findings indicate that “There has been a complete transformation in the investment-led growth in the Country. It has seen ups and downs and is now stabilizing, and the growth is steady.” This stabilization of investment patterns, especially within infrastructure and manufacturing domains, has created a solid platform for sustained economic development.

Mirroring other economic indicators, income distribution has also seen favorable trends. The researchers point out that ‘GNI has increased consistently over the past nine years, with a CAGR close to 5.6%.'”

Managing External Vulnerabilities: A Prudent Approach

India’s strategic management of global economic disruptions, especially during the Ukraine conflict, has been recognized in academic circles. As Dr. Onkarnath and Dr. Deepak Kumar observe: ‘The government’s handling of the situation was noteworthy, maintaining a steady crude supply through diversified sourcing, thereby stabilizing domestic fuel prices.'”

The country’s approach to external liability management also reflects strategic competence. The research points out that ‘as of September 2023, India’s external debt stood at USD 635.3 billion and is being managed effectively. The debt-to-GDP ratio has improved from 22.4% in March 2013 to 18.6% in September 2023, placing the economy in a relatively secure position.”

This prudent external financial management strategy has enabled India to pursue aggressive development policies while maintaining overall economic stability.

Employment Generation: Addressing the Demographic Challenge

While generating adequate employment for India’s growing population remains a policy challenge, the researchers highlight noteworthy progress: ‘India’s job market has seen considerable evolution over the last decade, with several encouraging trends promoting both economic and social development. Key drivers of this change include economic reforms, rapid technological growth, and initiatives aimed at improving workforce competencies.”

Despite ongoing challenges in skill development and formal employment creation, fundamental structures supporting sustainable employment expansion appear to be consolidating.

Contemporary Challenges and Future Outlook

Dr. Onkarnath and Dr. Deepak Kumar adopt a realistic assessment of forthcoming economic challenges. Their research acknowledges that “While putting reforms in place, the Indian Economy has to face many challenges in the ever-changing dynamics,” including requirements for managing global integration processes, energy sector transitions, artificial intelligence impacts on labor markets, and the persistent challenge of “Skilling up the youth.”

India’s long-term economic outlook inspires considerable academic confidence. The analysis forecasts that ‘India will rise to become the third-largest economy within the next three years, achieving a USD 5 trillion GDP.’ The researchers also note the government’s broader objective—attaining developed nation status by the year 2047.”

Perhaps most significantly, the researchers conclude that “under reasonable assumptions regarding inflation differentials and exchange rates, India has the potential to become a USD 7 trillion economy within the next six to seven years, by 2030.” These projections are grounded in the substantial institutional reforms and economic momentum developed over the preceding decade.

Research Citation: Dr. Onkarnath & Dr. Deepak Kumar (2025). “Indian Economy in 2014 – 2024 and the transformation of India.” International Journal For Multidisciplinary Research, Volume 7, Issue 3, May-June 2025. DOI: 10.36948/ijfmr.2025.v07i03.47425

Dr. Onkarnath (PhD, MBA, M.Sc. Real Estate) is an Associate Professor at Asian Business School with 14 publications and 3 citations. Dr. Deepak Kumar (PhD TISS, M.Phil. TISS, PGDM) is an Assistant Professor at Asian Business School with 4 publications and 1 citation.