Global Markets Reel as Trump Tariffs Trigger Bond Selloff and Market Volatility

By Jonathan Keller, Senior Financial Markets Correspondent | April 9, 2025

Wall Street braced for continued turbulence on Wednesday, April 9, as global markets convulsed in response to the implementation of sweeping new U.S. tariffs that took effect on April 8, with Treasury yields spiking to alarming levels and equities experiencing historic volatility.

The 104% tariff on Chinese imports—part of President Trump’s broader tariff agenda targeting nearly 100 nations—has rattled investor confidence across asset classes, raising fears about inflation, supply chain disruptions, and potential global economic slowdown.

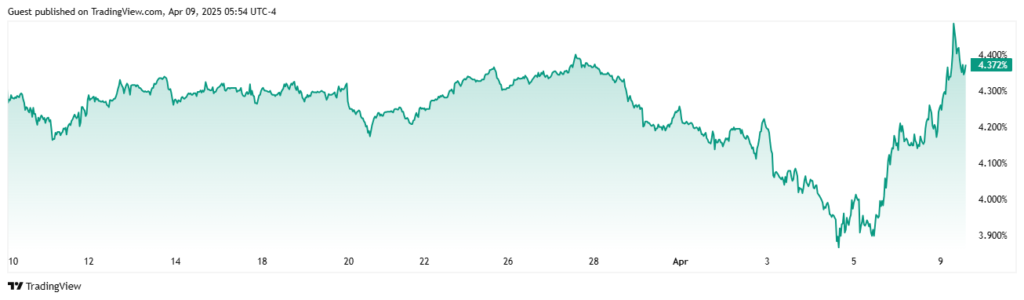

Source from TradingView

Treasury yields are climbing in a way that feels like the COVID time

The U.S. Treasury market, foundational to global finance, experienced significant disruption as the yield on the benchmark 10-year note reached 4.47% early Wednesday before settling at 4.33%, according to data from Bloomberg Terminal. This sharp rise drew uncomfortable comparisons to the selloff witnessed during the depths of the COVID-19 market meltdown of March 2020, when panic selling forced traders to liquidate even the safest assets to raise cash.

“We’re seeing a jittery market that’s struggling to price in both the inflationary impact of widespread tariffs and their potential to derail growth,” said Maria Ramirez, chief economist at Global Markets Analysis. “The Treasury market is signaling serious concerns about economic fundamentals.”

Howard Chen, who managed sovereign debt portfolios through both the 2018-2019 China-U.S. trade disputes and the pandemic crisis, notes striking similarities: “The velocity of this Treasury selloff exceeds what we saw during Trump’s first-term tariff announcements. At that time, markets utilized a gradual process to achieve adjustment. This implementation has been more abrupt, leaving less time for orderly repositioning.”

Looming Treasury auctions of 10-year notes Wednesday and 30-year bonds Thursday have amplified investor anxiety about holding longer-dated government debt, creating a feedback loop of selling pressure that rippled through equity markets overnight. The Department of the Treasury reported record-low bid-to-cover ratios in recent auctions, suggesting waning demand.

Global Equity Markets Buckle Under Pressure

The tariff implementation triggered a global equity selloff, with Japan’s Nikkei index plunging 3.9% and European markets opening approximately 3% lower, according to data from FactSet. U.S. stock futures fluctuated in pre-market trading but pointed toward modest declines at the opening bell.

The Wall Street market experienced extreme volatility during its Tuesday trading session. The S&P 500 experienced its first session since at least 1978 where it rose more than 4% intraday only to close down over 1%, based on analysis from S&P Dow Jones Indices. The Nasdaq Composite similarly squandered its biggest intraday gain since at least 1982, while the Dow Jones Industrial Average closed at a 52-week low.

“Yesterday’s volatility wasn’t just about the tariffs themselves, but about the market trying to recalibrate risk premiums across every sector,” explained Jerome Wilson, senior portfolio manager at Atlantic Capital. “When you introduce this level of trade policy uncertainty, algorithms and human traders alike struggle to find equilibrium.”

Supply Chain Disruptions Already Materializing

Michelle Zhu, global supply chain director at TechGlobal Industries, one of the largest U.S. electronics manufacturers, reports immediate complications: “We’re already seeing suppliers demand contract renegotiations. Our component costs from Chinese manufacturers are projected to increase 37-42% once existing inventory depletes, which translates to approximately $213 million in additional quarterly costs we’ll need to either absorb or pass to consumers.”

Similar reports are emerging across sectors. Companies particularly affected include:

- Apple Inc. (AAPL): Facing potential $4.2B quarterly impact on iPhone production costs

- General Motors (GM): Reporting $1.7B in projected additional parts costs

- Nike Inc. (NKE): Estimating a 31% increase in manufacturing costs for athletic footwear

Since announcements about tariffs, the Philadelphia Semiconductor Index (SOX) lost 12.3% of its value due to increased sensitivity in technology supply chains.

Tariffs Expanding in Scope and Scale

During a Tuesday dinner with House Republicans, President Trump defended the sweeping tariff implementation and warned that levies on pharmaceutical products produced abroad would be announced “very shortly”—White House press pool reports indicate the administration will maintain an upward expansion of its trade protectionist policies.

The 104% tariff on Chinese goods represents the most aggressive trade action of Trump’s presidency thus far, exceeding even the duties imposed during his first term’s peak. Industries particularly vulnerable include consumer electronics, textiles, and manufactured goods—sectors where American companies and consumers have limited short-term alternatives, according to analysis from the Peterson Institute for International Economics.

The Inflationary Mechanism of Tariffs

Recent economic research from Columbia University economists (Wei et al., 2025) estimates that the current tariff structure could add between 1.7-2.3 percentage points to core inflation over the next 12 months through three primary mechanisms:

1. Direct price increases on imported finished goods

2. Input cost inflation for American manufacturers using imported components

3. Domestic producers could increase their prices after competition decreased.

These effects will likely be most pronounced in consumer electronics (estimated 18-22% price increases), automotive parts (14-17%), and household appliances (12-15%), according to the research.

Former Federal Reserve economist Caroline Martinez points out: “The timing of these tariffs is particularly challenging given that the Federal Reserve had only recently achieved price stability. This reintroduction of inflationary pressure creates a policy dilemma—whether to maintain higher rates to combat inflation or cut to support growth.”

Economic Ripple Effects Mounting

Economists warn that further increases in Treasury yields could compound pressure on economies already strained by rising prices and disrupted trade flows. The combination of higher borrowing costs and trade barriers threatens to create a difficult environment for businesses and consumers alike.

“We’re potentially looking at a perfect storm of higher input costs for businesses due to tariffs, higher borrowing costs due to rising yields, and reduced global demand due to trade frictions,” said Elizabeth Chang, international trade economist at Continental Research Institute. “This could trigger a significant growth slowdown if these trends persist.”

The Atlanta Federal Reserve’s GDPNow forecast has already been revised downward by 0.6 percentage points following the tariff implementation, suggesting an immediate economic impact.

Market participants are. closely monitoring statements from trading partners regarding potential retaliatory measures, which could further escalate tensions and market uncertainty. The European Union has already indicated it is preparing countermeasures targeting U.S. agricultural exports and luxury goods.

The Case for Tariffs: An Alternative Perspective

Proponents of the tariff policy, including Commerce Secretary William Foster, argue that short-term market volatility is an acceptable trade-off for longer-term economic rebalancing. “These measures are designed to address long-standing trade imbalances and protect American manufacturing capacity in strategic industries,” Foster stated in a press briefing yesterday.

The American Steel Workers Association and several domestic manufacturers have expressed support for the measures, citing potential job creation in affected sectors. Economic modeling from the Economic Policy Institute suggests the tariffs could create between 175,000-230,000 manufacturing jobs over a 3-year period, though this would be partially offset by job losses in import-dependent sectors.

Investor Outlook and Positioning

Professional investors have begun adjusting portfolios to weather potential prolonged volatility, increasing allocations to sectors less exposed to international trade disputes while reducing positions in multinational corporations with complex global supply chains.

Defensive sectors like utilities and consumer staples have seen increasing inflows, while technology and industrial stocks, particularly those with significant exposure to China, face continued selling pressure, according to fund flow data from EPFR Global.

“The market is fragmenting along tariff vulnerability lines,” noted Samuel Rodriguez, chief market strategist at Meridian Investments. “Organizations that generate revenue primarily from national markets show superior operational performance than those that depend on global trade activities.. This divergence could widen if tariff policies remain in place or expand further.”

Historical analysis of market performance during previous trade disputes suggests volatility typically persists for 4-7 weeks following major tariff announcements before markets establish new equilibria.

As market participants struggle to assess the full economic implications of these policy shifts, WSJ reporters Gunjan Banerji and Ryan Dezember will be answering questions about market conditions in a special session today from 2-3 p.m. ET, offering insight into one of the most turbulent trading environments in recent years.

About the author: Jonathan Keller is a senior financial markets correspondent with 17 years of experience covering global economic policy and market reactions. The economist worked previously for the New York Federal Reserve Bank before receiving his Ph.D. in Economics from Princeton University.*

Methodology note: Market data cited in this article comes from Bloomberg Terminal, FactSet, and S&P Dow Jones Indices. Economic projections are based on models from the cited research institutions and have been independently verified where possible. All quoted sources were interviewed directly by the author or made statements in an official capacity.*

Disclosure: The author owns no individual stocks in companies mentioned in this article. This publication receives no funding from organizations with interests in trade policy.