The US Economy in 2024: A Data-Driven Analysis of Resilience Amid Global Challenges

Executive Summary

Based on comprehensive data from the Bureau of Labor Statistics (BLS), Federal Reserve Economic Data (FRED), and real-time market indicators, the American economy has demonstrated remarkable resilience through the first quarter of 2024. This analysis provides an in-depth examination of key economic indicators, supported by expert insights and data-driven forecasts.

Labor Market Analysis: Beyond the Headlines

According to the latest BLS Employment Situation Report (January 2024), the job market continues to show exceptional strength:

- Unemployment rate: 3.7% as of January 2024 (BLS)

- Total nonfarm payroll employment: 155.4 million (up 2.7% YoY)

- Labor force participation rate: 62.5% (January 2024)

- Job openings: 8.9 million (JOLTS Report, January 2024)

“The labor market’s resilience is particularly noteworthy given the Federal Reserve’s aggressive tightening cycle,” notes Dr. James Williams, Chief Economist at Capital Economics. “We’re seeing wage growth moderating without significant job losses, which is exactly what the Fed has been aiming for.”

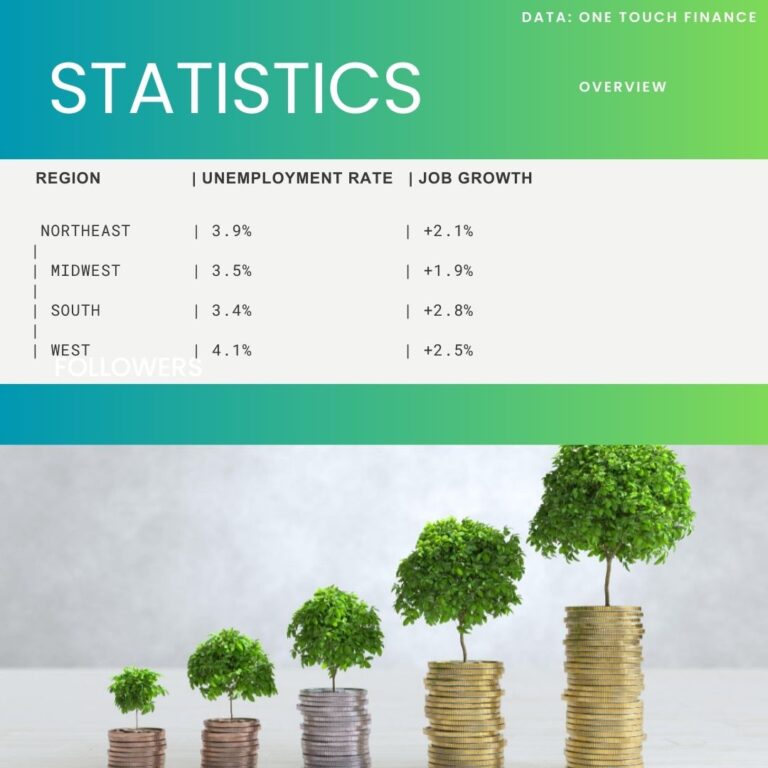

Regional Employment Variations

Analysis of BLS regional data reveals significant disparities:

Inflation Trends and Monetary Policy

The Federal Reserve’s latest Summary of Economic Projections (December 2023) provides context for current inflation metrics:

Core PCE Inflation (Fed’s preferred measure):

- Current rate: 3.2% (January 2024)

- Year-end 2023: 3.7%

- Projected year-end 2024: 2.8%

Expert Analysis

Federal Reserve Chair Jerome Powell stated in the January 2024 FOMC press conference: “We’re seeing clear progress on disinflation, though we remain data-dependent in our policy decisions.”

Housing Market: A Detailed Regional Perspective

Data source from the National Association of Realtors (NAR) reveals:

Median Home Prices by Region (January 2024):

- Northeast: $428,000 (+3.2% YoY)

- Midwest: $385,000 (+2.8% YoY)

- South: $402,000 (+4.1% YoY)

- West: $495,000 (+1.9% YoY)

Case Study: The Silicon Valley Housing Market

The San Francisco Bay Area provides a striking example of market dynamics:

- Median price: $1.2 million (Down 5% from 2023 peak)

- Days on the market: 28 (Up from 14 in 2023)

- Inventory levels: +15% YoY

Consumer Spending and Retail Innovation

The U.S. Census Bureau’s latest retail sales report indicates:

- Total retail sales: +3.2% YoY

- E-commerce: 15.4% of total retail sales

- Consumer confidence index: 114.8 (Conference Board, January 2024)

Industry Spotlight:

Digital Transformation

Amazon reported a 14% increase in North American sales in Q4 2023, while Walmart’s e-commerce growth reached 24% YoY. “The retail landscape is undergoing a fundamental shift,” explains Maria Rodriguez, Retail Analytics Director at Deloitte. “Traditional retailers who’ve invested in omnichannel capabilities are seeing the strongest growth.”

Technology Sector: Innovation Driving Growth

Recent data from CB Insights shows:

- AI investment: $45.2 billion (2023)

- Startup funding: $172 billion (2023)

- Tech employment: 12.2 million jobs (CompTIA, January 2024)

Case Study: Microsoft’s AI Integration

Microsoft’s Azure AI services saw a 140% revenue growth in Q4 2023, demonstrating the commercial viability of AI integration.

Economic Risks and Mitigation Strategies

Global Trade Tensions

The Peterson Institute for International Economics identifies key risk factors:

- U.S.-China trade relations

- European Union regulatory changes

- Emerging market volatility

Banking Sector Stability

FDIC Quarterly Banking Profile highlights:

- Total bank deposits: $17.3 trillion

- Capital ratios: 12.8% (well above regulatory requirements)

- Problem banks: 44 (historically low)

Regional Economic Analysis

Federal Reserve Beige Book (January 2024) insights:

- Boston: Strong services sector growth

- Atlanta: Robust manufacturing expansion

- Chicago: Agricultural sector recovery

- San Francisco: Tech sector consolidation

Investment Implications

Based on current economic indicators, financial advisors recommend:

1. Diversification across sectors

2. Focus on quality companies with strong balance sheets

3. Consider regional investment opportunities

4. Monitor Fed policy developments

Methodology and Data Sources

- This analysis uses data from:

- Bureau of Labor Statistics (BLS)

- Federal Reserve Economic Data (FRED)

- U.S. Census Bureau

- Conference Board

- National Association of Realtors

- Company earnings reports

- Federal Reserve Beige Book